The optics market as a whole has expanded rapidly over the past decade, and the boom in rifle scopes illustrates that growth better than any single product. Hunting enthusiasts, competitive shooters, and military units depend on these devices for accurate long-range aim. What began as budget-tier models has transformed; Chinese scope manufacturers now blend innovative engineering, cost efficiency, and seamless integration with global logistics to dominate a sizeable segment of the field. Because of that, the label “scopes made in China” no longer evokes just entry-level glass-instead it describes everything from value hunting rigs to high-end precision optics trusted by professional leagues and well-known international brands.

In this section, we look at the elements that turned China into the beating heart of scope production, spotlight the home-grown manufacturers leading the charge, and show how western firms tap into Chinas vast factories to bring their designs to life.

The Role of China in the Global Scope Market

China’s strategic importance in the global scope market is undeniable. Its ascent is built upon a foundation of robust infrastructure, continuous innovation, cost efficiencies, and collaborative partnerships.

Why China is a Scope Manufacturing Hub:

A. Robust Manufacturing Ecosystem:

China’s strength as a scope factory lies in its comprehensive manufacturing ecosystem. This includes ready access to raw materials critical for optics production, such as high-quality optical glass and aluminum for scope bodies. Beyond raw materials, China boasts a vast and increasingly skilled labor force and engineering talent specializing in precision manufacturing. Major optical manufacturing clusters, particularly in regions like Guangdong and Zhejiang, are equipped with advanced machinery and production lines that can handle everything from intricate lens grinding and polishing to complex assembly processes. This extensive network ensures highly efficient supply chains and logistics, enabling rapid production and distribution.

B. Investment in Research & Development (R&D) and Innovation:

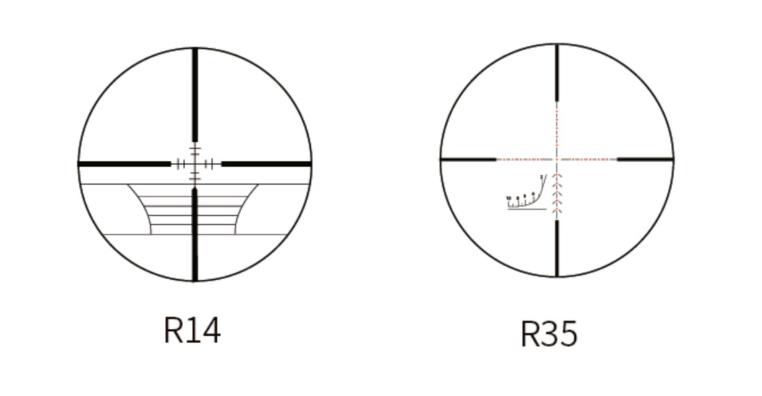

A significant shift in the Chinese optics industry has been the move from simple replication to genuine investment in Research & Development and innovation. Manufacturers are actively pursuing improvements in optical clarity and lens coatings. For instance, many now consistently apply Fully Multi-Coated (FMC) or enhanced multi-coated treatments to lenses, dramatically improving light transmission and reducing glare. There’s also a strong focus on the development of advanced reticle designs, including First Focal Plane (FFP) and Second Focal Plane (SFP) options, as well as bright, reliable illuminated reticles. Furthermore, the integration of modern features like digital thermal imaging, laser rangefinders, and even ballistic calculators into their scopes showcases a commitment to pushing technological boundaries. This strategic investment is allowing leading Chinese firms to close the gap with traditional market leaders, making their china scope offerings more competitive than ever.

C. Cost-Effectiveness and Economies of Scale:

Despite advancements in technology and quality, Chinese scope manufacturers maintain a significant competitive edge due to their cost-effectiveness. Lower labor costs compared to Western nations, combined with the immense ability to produce high volumes through economies of scale, allow them to offer products at highly competitive prices. This accessibility has been instrumental in making quality optics accessible to a broader global consumer base, democratizing the market for various shooting disciplines and outdoor activities. The “scope wholesale” market from China is particularly vibrant, offering lucrative opportunities for distributors worldwide.

D. OEM/ODM Capabilities and Global Partnerships:

A critical, though often unseen, aspect of China’s dominance is its extensive Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) capabilities. This means many Chinese scope factories produce scopes that are then rebranded and sold by famous international brands. Under OEM/ODM agreements, Chinese manufacturers produce based on the designs and specifications provided by the client (OEM), or they design and manufacture products that clients can brand (ODM). This collaborative experience fosters quality control and adherence to international standards, as these factories must meet the stringent demands of their global partners. For example, SAM Electrical Equipments (Nantong) Co., Ltd., a significant chinese scope manufacturer, has publicly stated partnerships with major global players such as Bushnell, Tasco, Gamo, BSA, Leupold, Nikon, and Hakko. While the exact nature and current status of these individual partnerships can vary and are often proprietary, this illustrates the deep and long-standing integration of Chinese production into the supply chains of many renowned scope brands.

Insights on the Scopes Made in China

China holds a dominant position in global scope production. Over 80% of the world‘s rifle scopes are manufactured in China, with Jiangsu‘s Nantong region accounting for more than 60% of the country’s output. This dense industrial cluster benefits from a fully integrated supply chain and employs tens of thousands of skilled workers.

Due to strict firearm regulations, the domestic civilian market for scopes in China is minimal. As a result, the majority of Chinese-manufactured scopes are exported. In 2023, China’s scope market was valued at approximately RMB 4.55 billion, while the global market reached about RMB 36.75 billion (around USD 5.53 billion). By 2029, the global scope market is projected to grow to nearly RMB 58.75 billion.

Export remains the primary sales channel. Chinese scopes are widely used in North America, Europe, and growing markets in Asia and the Middle East. The United States alone, accounting for roughly 70% of global civilian scope demand, heavily relies on Chinese-made optics for its mid- and entry-level product segments. Although high-end military-grade optics are still imported by China in smaller quantities, the country maintains a significant trade surplus in the sector.

In terms of value, Chinese scopes represent over 12% of the global market and potentially more than 50% of global scope trade volume by export. This firmly establishes China as the leading producer and exporter of rifle scopes worldwide, driven by its cost advantage, production capacity, and increasingly sophisticated product offerings.

Global Brands with Chinese Manufacturing Roots

The global optics industry is intricately linked through manufacturing partnerships, with China serving as a cornerstone for production. Here we introduce you how both established international names and rising domestic china scope brands leverage Chinese manufacturing capabilities.

Global Scope Brands with Manufacturing Plants in China

It is a common industrial practice for leading international scope brands to strategically leverage manufacturing facilities in China. While direct ownership of entire factories might be less common for some, many establish long-term relationships with Chinese scope factories that serve as dedicated production partners. This strategic decision is driven by several compelling benefits:

- Reduced Costs: Access to a competitive labor market and economies of scale significantly lowers production costs, allowing brands to offer more competitive retail prices or maintain higher profit margins.

- Scalable Production: Chinese factories offer immense scalability, enabling brands to quickly ramp up production to meet fluctuating global demand for their scopes made in China.

- Access to Specialized Expertise: China has developed specialized expertise in various aspects of optical manufacturing, including lens crafting and advanced coating techniques, which benefits foreign partners.

A notable example is Vortex Optics, a highly popular American brand. While Vortex maintains its headquarters and some specialized production in the U.S., several of its well-regarded series, including the Crossfire II, Diamondback, and Diamondback Tactical lines, are produced in China. What’s critical to note is that this production is reportedly overseen by Japanese optics experts, ensuring strict quality control and adherence to Vortex’s specifications. This demonstrates how an international brand can integrate Chinese manufacturing while upholding its reputation for quality.

Other major global scope manufacturers such as Leupold and Bushnell are likely engage in similar practices, producing components or entire lower to mid-range product lines in China to optimize their global supply chains.

Leading Chinese Scope Manufacturers and Brands

Beyond being an OEM/ODM hub, China has nurtured its own robust ecosystem of Chinese scope brands that are gaining significant global traction. These companies are no longer content with just manufacturing for others; they are actively developing their own brands, investing in R&D, and implementing aggressive market strategies.

Here’s an overview of some of the top local Chinese brands:

| Brands and Manufacturers | Key Focus Areas | Notable Features / Strengths | Global Influence |

| Nantong Bester Optics Co., Ltd. | Rifle scopes (fixed, variable, red dot), spotting scopes | 200+ models, annual capacity of 800,000 units, full optical production line | Exported widely to the US, Canada, Australia, and Europe |

| Zhangshi Optical Instrument Co., Ltd. | Traditional rifle scopes and precision optical instruments | Reliable quality, domestic-leading processes, long-standing manufacturing experience | Stable presence in both domestic and overseas markets |

| Guangzhou Focuhuterotic Optics | Tactical, hunting, and red dot scopes; scope mounts | OEM/ODM customization, emphasis on clarity, durability, and tactical precision | Competing in mid-to-high-end international market |

| Wuhan GML Optical Tech Co., Ltd. | Night vision scopes, thermal scopes | Advanced R&D, waterproof/fogproof/shockproof designs, military-grade testing | Products used by PLA, police forces, exported to Asia and Africa |

| Guide Infrared Co., Ltd. | Thermal imaging sights and systems | Owns core chip tech (IR FPA), all-weather imaging capability | Supplies Chinese military, exports to multiple global markets |

| Foreseen Optics | Hunting and outdoor optics including scopes, red dot sights, binoculars, and rangefinders etc. | 34+ Optical Factory, OEM/ODM flexible production, supports global wholesale/distribution | Seeking distributors globally, focus on international B2B markets |

| VISIONKING | Civilian rifle scopes, red dots, night vision | Established brand, affordable, wide product range | Popular in China, growing exports via online platforms |

| Vector Optics | Tactical scopes, sports optics | High cost-performance ratio, known in shooting competitions | Strong presence in Europe and North America |

These china scope brands are employing aggressive market strategies that include direct-to-consumer sales, robust online presence, and establishing wholesale programs for international distributors. Their rising influence globally demonstrates a clear shift in how consumers perceive and acquire optics from Chinese manufacturers.

Where to Buy Scopes Made in China

The accessibility of scopes made in China is broad, catering to both individual buyers and businesses seeking scope wholesale opportunities.

- Direct from Manufacturers/Wholesalers:

For businesses looking to stock a diverse range of optics or develop their own branded products, sourcing directly from manufacturers/wholesalers in China is a viable option. Platforms like Alibaba.com and Made-in-China.com serve as primary gateways, connecting buyers with hundreds of chinese scope manufacturers and scope factories. These platforms facilitate wholesale options for businesses, offering bulk pricing, customization services (OEM/ODM), and direct communication with production facilities. Many Chinese brands also have dedicated international sales teams to assist with bulk orders and global distribution.

- Brand Websites and Online Retailers:

Individual buyers have ample opportunities to purchase scopes made in China through various channels. Many leading china scope brands, such as Foreseen Optics, operate their own official websites with international shipping. Additionally, a wide array of global online retailers specializing in hunting, shooting, and outdoor gear stock an extensive selection of scopes made in China. These platforms often provide detailed product specifications, customer reviews, and return policies, making it convenient for individual buyers to research and purchase.

- Local Dealers:

The growing acceptance and improved quality of scopes made in China mean they are increasingly available through local sporting goods stores and specialized firearms/optics dealers. Many distributors are recognizing the value proposition of these products. For instance, some Chinese brands actively seek to expand their reach by partnering with local distributors, such as Foreseen, enabling them to bring their products into brick-and-mortar stores and provide local customer support. This growing presence ensures that consumers can examine products firsthand and receive personalized advice.

Final Thoughts

China’s transformation in the global scope market is a testament to its evolving industrial prowess and strategic vision. From being a largely uncredited manufacturing base, it has emerged as a powerhouse of innovation, production, and increasingly, brand development. The deep Chinese roots now extend through many global brands, from the widely used Vortex Optics series manufactured in China to the rapidly expanding portfolios of indigenous china scope brands like Vector Optics and Gushin Optics.

This dynamic shift has reshaped the scope manufacturers landscape, driving down costs, fostering innovation, and significantly enhancing the quality and features available in scopes made in China. For consumers worldwide, this translates into more choices, better value, and a broader accessibility to advanced optical technology. As the industry continues to evolve, China’s central role as a china scope manufacturer will undoubtedly remain a defining force in the global optics market.